Basic Earnings Per Share EPS: Definition, Formula, Example

In addition, company executives must file a 10-Q with the SEC, which contains the quarterly income statement. It is important to note that generated revenue per share can be determined for different periods of time by taking into service the earnings per share calculator. Let us examine an example that describes the purpose of a tool in a better way. It is a widely used metric to analyze the performance and profitability of different companies. A higher EPS shows that a company generates more profit and that its stock is worth more while a low EPS value indicates a company has a high debt load.

Basic Earnings Per Share Example

- The company’s management team decides to sell the factory and build another one on less valuable land.

- Some data sources simplify the calculation by using the number of shares outstanding at the end of a period.

- Without diluted EPS, it would be easier for the management to mislead shareholders regarding the profitability of the company.

This measurement figures into the earnings portion of the price-earnings (P/E) valuation ratio. The P/E ratio is one of the most common ratios utilized by investors to determine whether a company’s stock price is valued properly relative to its earnings. Another consideration for basic EPS is its deviation from diluted EPS. If the two EPS measures are increasingly different, it may show that there is a high potential for current common shareholders to be diluted in the future. The earnings per share calculation is a valuation metric that allows investors to look at a company’s profits per share. With a little back-of-the-napkin math, investors can judge whether the stock is “cheap” or “expensive” based on how much income it generates on a per-share basis.

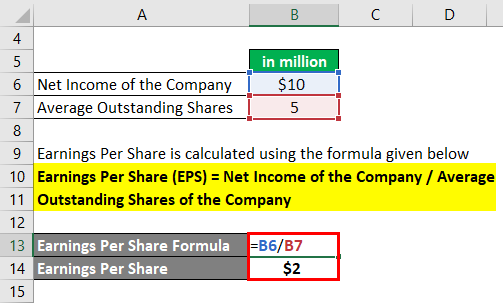

What Is the Formula for Earnings per Share?

When analysts or investors use earnings per share to make decisions, they are usually looking at either basic or diluted earnings per share. When a company has enough profit to pay shareholders but chooses not to, Retained earnings per share is the amount of money that would have gone to shareholders. For example, if a company has 100 units of common shares and makes 1000 USD to pay shareholders, each share unit will be worth 10 USD. If the firm is dissolved, investors who hold preferred shares will be reimbursed the amount they paid for the shares.

EPS = (Net Income – Preferred Dividends) / Shares Outstanding

The core reason is that share counts can be extraordinarily different. Both metrics can be used to understand the fair value of a stock — but from very different perspectives. To oversimplify cash flow worksheet somewhat, book value per share is a calculation of a company’s assets per outstanding share. EPS shows what profit per share the company can generate with those assets.

EPS and Price-to-Earnings (P/E)

The section will contain the EPS figures on a basic and diluted basis, as well as the share counts used to compute the EPS. EPS stands for earnings per share, which is the amount of a company’s net earnings per share of outstanding stock. There are several types of earnings per share, including cash, reported, continuous/pro forma, carrying value, and retained EPS. A pro forma or continuing earnings per share is a variant of earnings per share that excludes one-time events and extraordinary occurrences. The reported earnings per share are calculated using generally accepted accounting principles. The company declares this during its filing with the Stock Exchange Commission.

Diluted EPS is usually lower than basic EPS because it takes into account the potential dilution of earnings that could occur if all dilutive securities were exercised. EPS stands for Earnings Per Share, a financial metric representing the portion of a company’s profit allocated to each outstanding share of common stock. Basic EPS considers only the number of common shares outstanding, while diluted EPS takes into account the potential dilution from convertible securities, such as stock options or convertible bonds.

Since every share receives an equal slice of the pie of net income, they would each receive $0.068. Understanding EPS is a step in fundamental analysis — but only a step. Bank of America (BAC), for example, is in the financial services sector. Investors can compare the EPS of Bank of America with other financial institutions, such as JP Morgan Chase (JPM) or Wells Fargo (WFC), to get an idea of relative financial strength.

A more refined calculation adjusts the numerator and denominator for shares that could be created through options, convertible debt, or warrants. The numerator of the equation is also more relevant if it is adjusted for continuing operations. Earnings per share, or EPS, is a ratio that divides a company’s earnings by the number of shares outstanding to evaluate profitability and gain a pulse of the company’s financial health. Basic earnings per share are most accurate when calculating for companies with uncomplicated financial structures or that only have common shares. In other words, before common shareholders get any profit, dividend payments have already been sent to preferred shareholders. When the EPS growth rate is low (under 2%) or the company has reported consecutive negative EPS, there is no sense in calculating the growth rate.

As demonstrated in the example, if a company’s earnings per share are 200USD, then investors will be more likely to invest in that company. Oftentimes, those who hold a preferred cumulative share are given some form of compensation for the unreasonable delay in receiving their dividends. This implies that preferred shareholders do not have the ability to vote for the board of directors or a corporate policy. Preferred shares, on the other hand, provide preferred shareholders with no voting rights. Because of their right to vote for corporate policies and elect board members, common shares are also known as ordinary shares or voting shares. From an investment standpoint, common stockholders usually profit more handsomely in the long run.

Ensure you are using the most recent financial statements and that all figures are correctly inputted. Net Income is the total profit a company makes after deducting all expenses, taxes, and costs. In this example, that could increase the EPS because the 100 closed stores were perhaps operating at a loss. By evaluating EPS from continuing operations, an analyst is better able to compare prior performance to current performance.